- Commerce

56 Black Friday Stats from Last Year You Need to Know for 2024

1,000,000,000,000!

Could holiday sales surpass the $1 trillion mark this season?

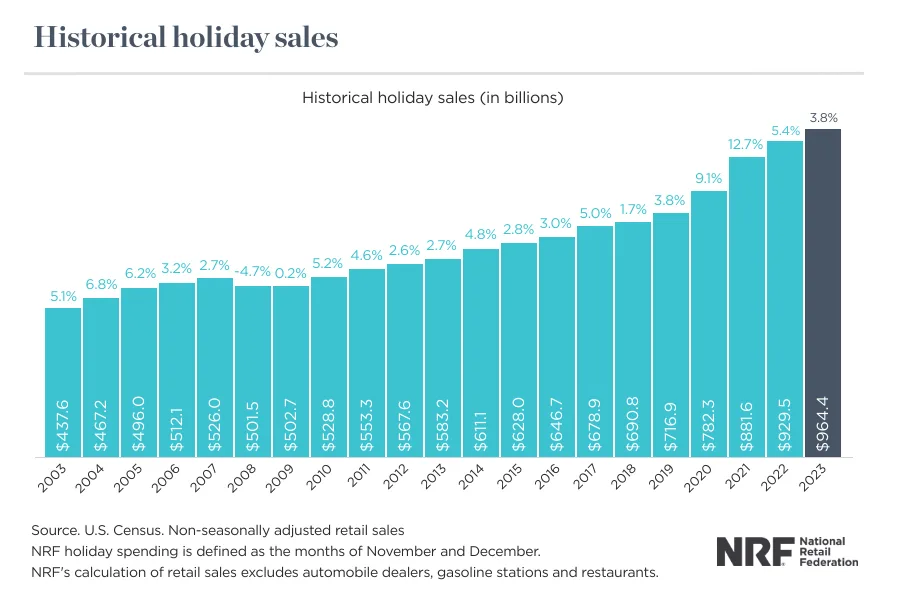

According to NRF, 2023 holiday sales hit a record $964.4 billion, up 3.8% from the previous year.

Great news for retailers!

With proper preparation, you can take full advantage of Black Friday and Cyber Monday traditions this year.

BUT, How can you prepare effectively?

Using last year's insights, we've compiled all the relevant statistics and findings on shoppers' intentions, expectations, and insights to help you maximize your potential.

Let's begin by reviewing the major discoveries from last year!

1. General Insights from Last Year’s Black Friday Sales Numbers

Black Friday sales reached unprecedented levels in 2023, with core retail sales increasing by 3.8% year-over-year and totaling $964.4 billion.

This growth highlights a robust consumer spending pattern, with average spending per consumer also rising.

Popular product categories that drove this surge included electronics, fashion, and home goods.

The significant uptick in revenue underscores the effectiveness of retailers' targeted promotions and the continuing enthusiasm for holiday shopping.

1. Data released by the U.S. Census Bureau indicates that core retail sales during the 2023 holiday season increased by 3.8% compared to 2022, reaching a record $964.4 billion.

2. According to an Adobe report, Black Friday e-commerce spending surged by 7.5% in 2023 from the previous year, hitting a record $9.8 billion in the U.S.

3. According to Deloitte, holiday participation in 2023 reached pre-pandemic levels at 95%, up from 92% in 2022.

4. The average shopping duration has decreased to 5.8 weeks from 7.4 weeks in 2019, giving retailers a shorter timeframe to engage customers (Deloitte).

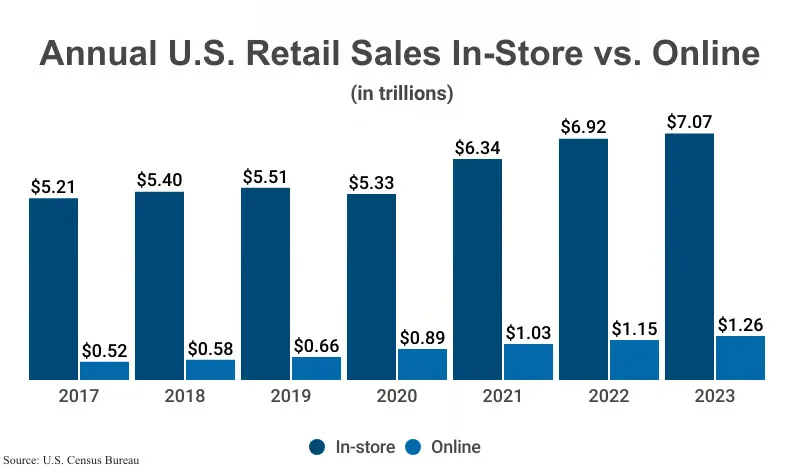

5. In-store shopping continues to generate higher sales revenue than online shopping. In 2023, American consumers spent $7.07 trillion in retail stores compared to $1.26 trillion online (CapitalOne Shopping Research).

2. E-commerce Specific Statistics

E-commerce experienced notable growth during the 2023 Black Friday, with online sales surging compared to previous years.

E-commerce platforms saw a significant rise in website traffic, translating into higher revenue from their web stores. This trend underscores the importance of mobile-friendly websites and effective digital marketing strategies in capturing the holiday shopping rush.

6. During the 2023 holiday season, mobile reached a new milestone, with smartphones accounting for 51.1% of online sales, up from 47% in 2022.

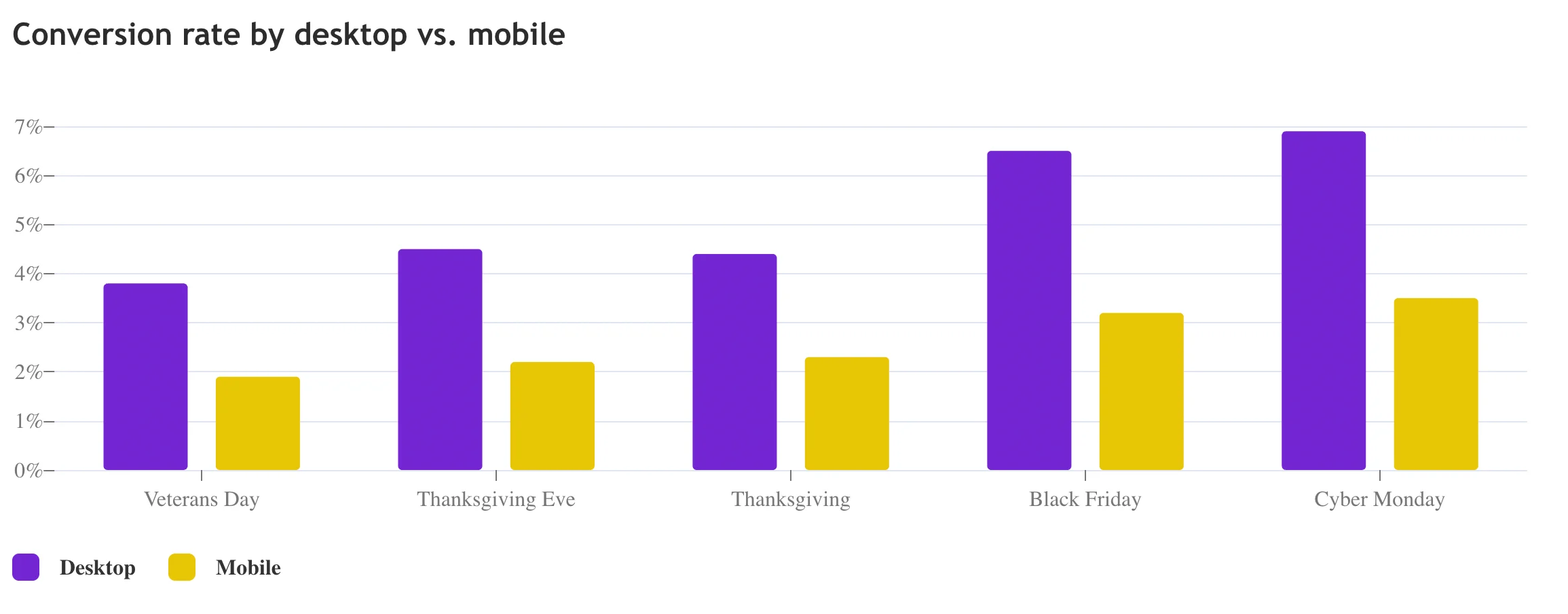

7. Desktops boast a 5.6% conversion rate, outperforming mobile devices, which have a 3.3% conversion rate (Statista).

8. Online-only retailers (63%) and mass merchants (53%) have regained their status as the most preferred formats, returning to 2019 levels (Deloitte).

9. Shopify store owners reported that the average order total for Black Friday 2022 was $102.10, slightly up from $100.70 in 2021.

10. According to Impact, clicks surged by 23% as shoppers researched their wishlists. The era of Cyber Week window shopping is over. Nowadays, more than half of all shoppers prepare their wishlists in advance, poised to act when they discover the best deals. Last year, the rise in clicks leading up to Cyber Week showcased how consumers compared discounts and evaluated their options in anticipation of the sale days.

11. Amazon, the leading online mass retailer, captured up to 17.7% of total Black Friday revenue (CapitalOne Shopping Research).

3. In-Store Shopping Statistics

In-store shopping saw a substantial turnout during Black Friday 2023, with a significant number of shoppers visiting physical stores.

While online spending continues to grow, brick-and-mortar locations still capture a considerable share of consumer dollars. This trend highlights the enduring appeal of in-store experiences, even as e-commerce gains prominence.

12. According to Deloitte, the preference for in-store shopping has returned to pre-pandemic levels, with 37% of shoppers' budgets being allocated to in-store purchases, compared to 35% in 2022 and 36% in 2019.

13. Black Friday shoppers are 19.6% more inclined to make purchases online rather than in-store (CapitalOne Shopping Research).

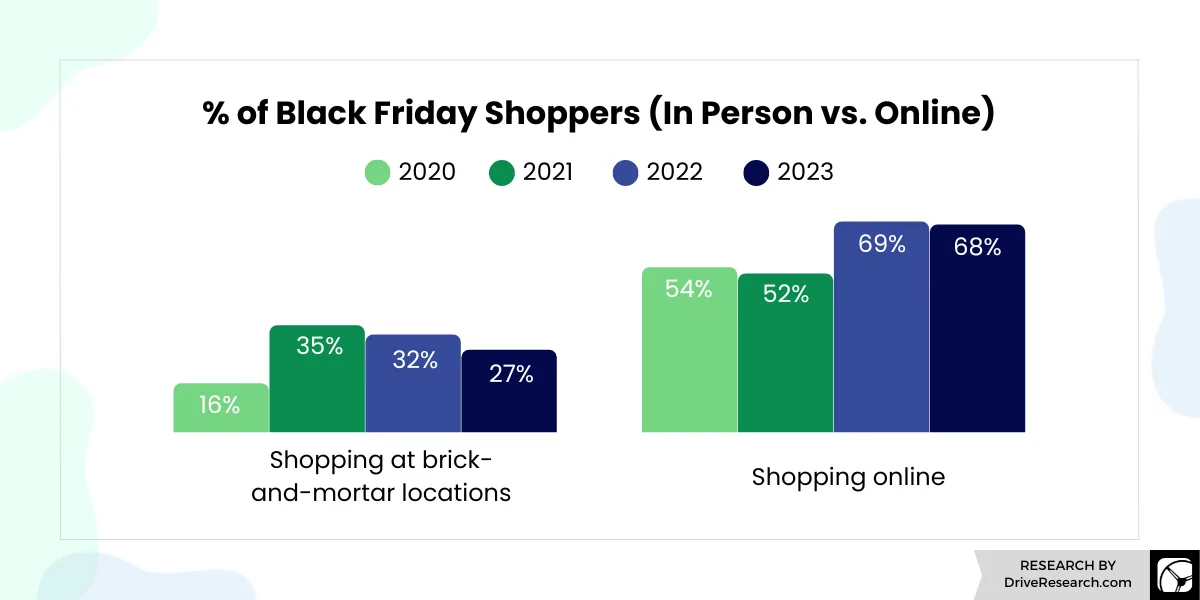

14. Online shoppers for Black Friday deals will outnumber in-person shoppers by 2.5 times, according to Drive Research.

15. Department stores are particularly popular among high spenders, with 40% favoring them compared to 18% of other shoppers (Deloitte).

16. According to CapitalOne Shopping Research, in 2022, 72.9 million consumers shopped in-store on Black Friday, marking a 9.62% year-over-year increase.

17. Black Friday shoppers are 16.4% less likely to visit physical stores compared to shopping online (CapitalOne Shopping Research).

18. In-store shoppers decreased by 28.3% compared to 2019 (pre-pandemic). Between 2015 and 2019, the percentage of Black Friday shoppers intending to shop in-store dropped by 20.7% (CapitalOne Shopping Research).

19. Consumers allocate 61.9% of their Black Friday spending to brick-and-mortar stores (CapitalOne Shopping Research).

4. Consumer Behavior Insights

20. According to an Adobe report, Black Friday e-commerce spending surged by 7.5% in 2023 from the previous year, hitting a record $9.8 billion in the U.S., further highlighting that price-conscious consumers are eager to find and spend on the best deals online.

21. According to Deloitte, preference for buy online, pick up in-store (BOPIS) has declined, with 28% planning to use this channel to acquire gifts this year, compared to 35% in 2022.

22. The top reasons for reduced holiday spending in 2023 include rising living costs (78%), increasing grocery prices (67%), and high inflation (60%).

23. In 2023, November-December holiday sales experienced year-over-year growth in seven out of nine retail categories, with electronics and appliance stores, health and personal care stores, and online sales leading the way. The specifics for key sectors over the two months, all on an unadjusted year-over-year basis, are as follows:

Electronics and appliance stores increased by 9.3%.

Health and personal care stores rose by 9%.

Online and other non-store sales went up by 8.2%.

Clothing and clothing accessory stores saw a 3% increase.

General merchandise stores grew by 2%.

Grocery and beverage stores were up by 1.1%.

Sporting goods stores experienced a slight rise of 0.3%.

Building materials and garden supply stores declined by 3.9%.

Furniture and home furnishings stores fell by 6.2%.

24. Online shoppers are looking for low purchase thresholds, with an average willingness to spend $40 to qualify for free shipping (Deloitte).

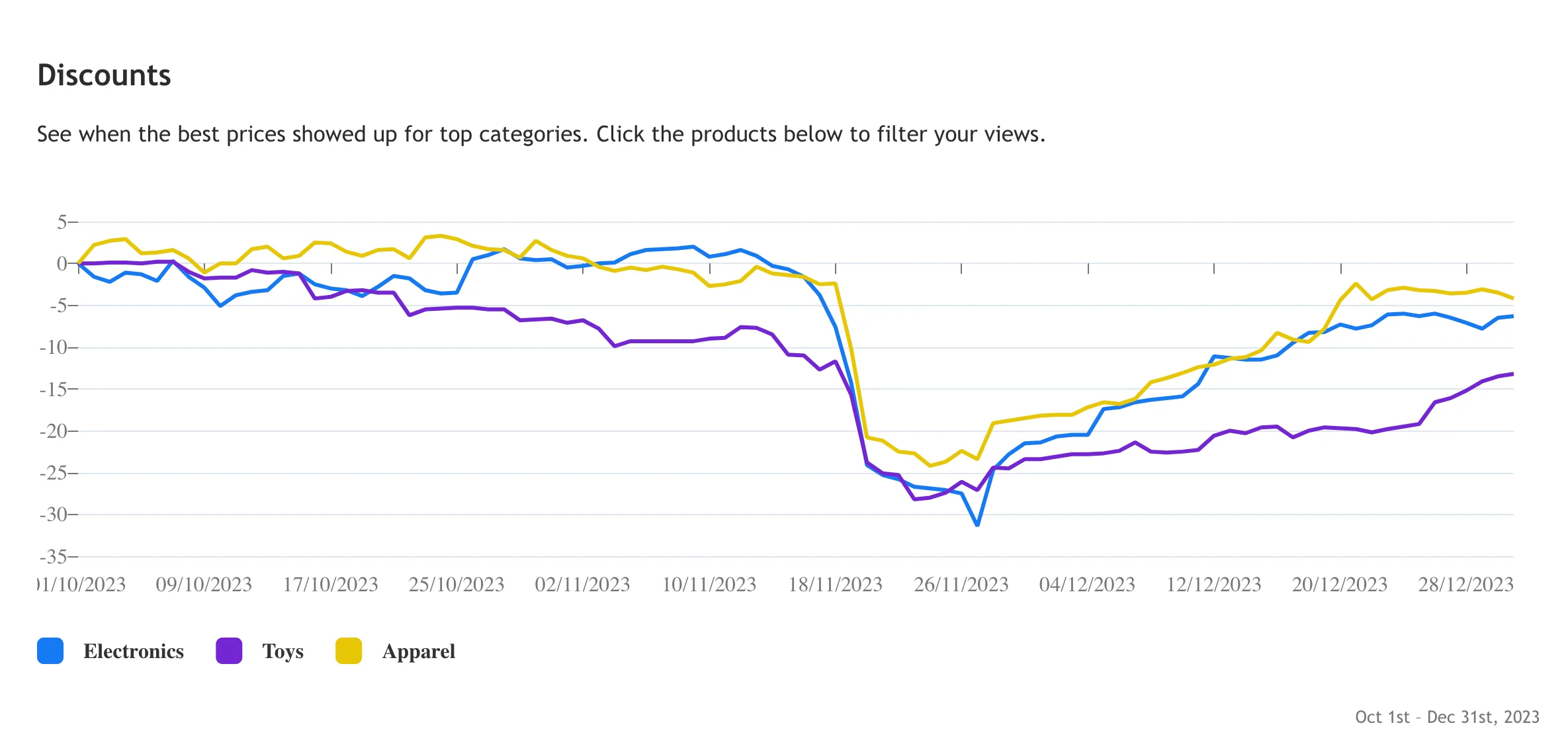

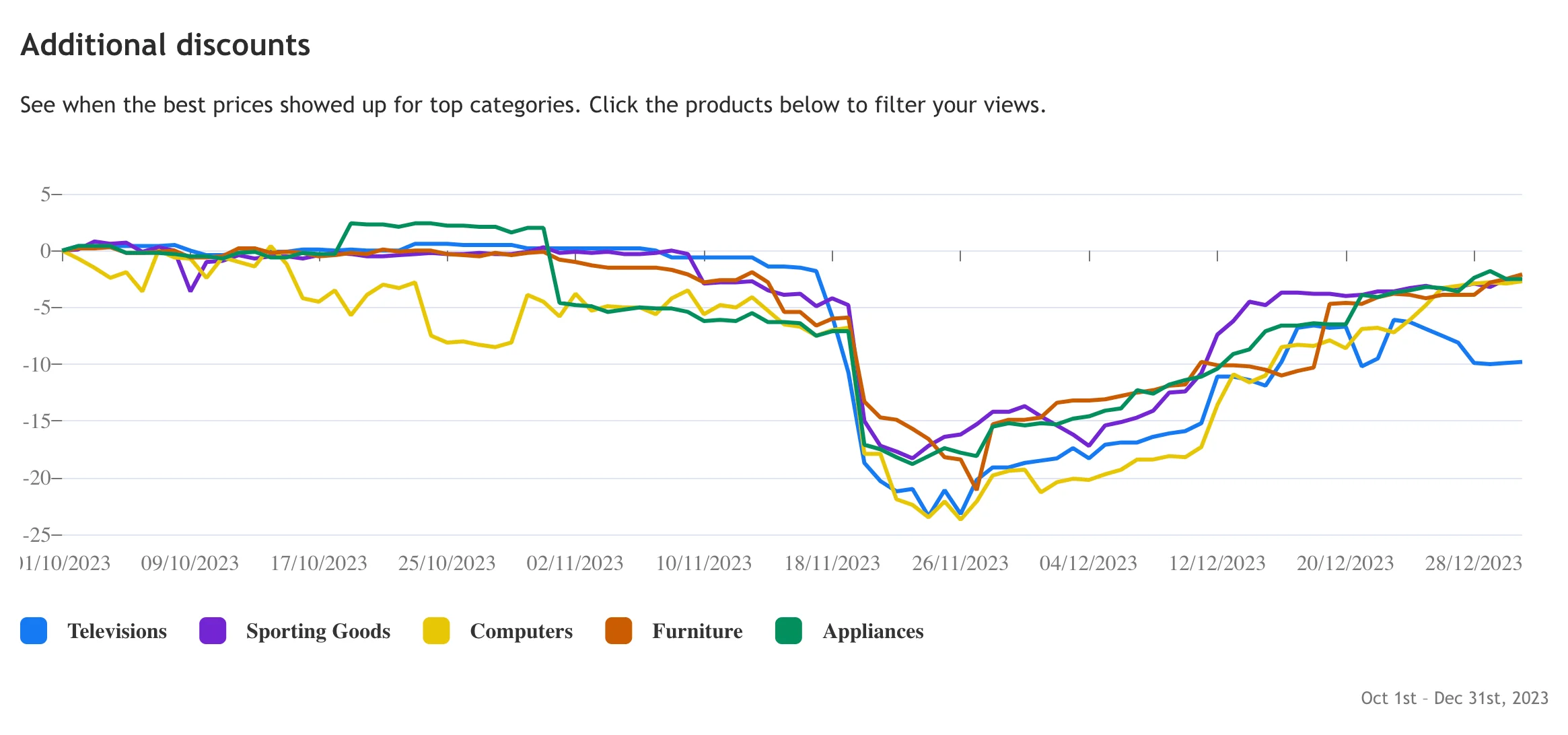

25. Across major e-commerce categories, discounts reached record highs this holiday season, according to Adobe Analytics:

Electronics: Discounts peaked at 31% off the list price (vs. 25% in 2022)

Toys: Discounts at 28% (vs. 34%)

Apparel: Discounts at 24% (vs. 19%)

Computers: Discounts at 24% (vs. 20%)

Televisions: Discounts at 23% (vs. 17%)

Appliances: Discounts at 18% (vs. 16%)

Sporting Goods: Discounts at 18% (vs. 10%)

Furniture: Discounts at 21% (vs. 8%)

26. Consumers are managing inflation by budgeting more for fewer gifts, with an average of eight gifts compared to nine in 2022, and by visiting fewer stores, averaging 4.2 visits versus 5.9 in 2022 (Deloitte).

27. Shoppers plan to allocate a larger portion of their budget to gift cards, increasing to $300 from $217 in 2022, while reducing spending on food and beverage gifts (Deloitte).

28. According to Deloitte, although 75% of consumers might be tempted to self-gift, limited budgets could pose a challenge.

29. The average spend on gifts, non-gifts, and experiences rose to $1,652 in 2023, marking a 14% year-over-year increase. This is up from $1,496 in 2019, reflecting a compound annual growth rate (CAGR) of 2.5%.

30. More than half of the younger generations prioritize sustainable products and packaging (Deloitte).

31. Fifty-four percent of Black Friday shoppers made impulse purchases, buying products without prior research (CapitalOne Shopping Research).

5. Marketing and Advertising Insights

Marketing campaigns during Black Friday 2023 demonstrated impressive returns on investment, with paid search leading the charge by accounting for 29.4% of online sales, as reported by Adobe Analytics.

Other effective channels included direct web visits, affiliates/partners, organic search, and email marketing. Despite generating less than 5% of total sales, social media's influence grew by 5% year-over-year, playing a crucial role in driving consumer engagement and awareness.

Platforms maintained stable engagement rates of 34%, highlighting social media's sustained impact on holiday shopping behaviors.

32. According to Adobe Analytics, throughout the 2023 holiday season, paid search continued to be the leading driver of sales for retailers, accounting for 29.4% of online sales.

33. Other significant contributors included direct web visits (19.3%), affiliates/partners (16.6%), organic search (15.9%), and email (15.3%). Although revenue directly from social media represented less than 5% of total sales, its share has grown by 5% year-over-year, according to Adobe.

34. According to Deloitte, social media usage has stabilized at 34%, the same as last year, after reaching its peak during the pandemic.

35. In November 2022, merchants sent nearly two billion promotional emails, marking a 28.5% increase from 2021. During the 2022 Black Friday/Cyber Monday (BFCM) period, a total of 820 million campaign emails were sent, representing a 26.9% year-over-year increase. The five peak days for email sends were all during the BFCM weekend:

Black Friday: 141 million

Cyber Monday: 118 million

Thanksgiving Day: 88 million

Sunday, November 27: 80 million

Saturday, November 26: 76 million

36. During BFCM week, 66% of shoppers are expected to take advantage of promotional events, a significant increase from 49% in 2022, as they look to offset rising prices, according to Deloitte.

37. Marketers increasingly utilized alternative communication channels to reach mobile consumers, resulting in a 37% growth in messages sent through push notifications, SMS, and streaming services (OTT) during Cyber Week. In contrast, traditional email saw a modest 9% increase (Salesforce).

6. Technology and Innovation

Technology and innovation always play a pivotal role in Black Friday, with AI and personalization significantly boosting sales through tailored experiences and recommendations.

Retailers increasingly adopted advanced technologies to enhance the shopping experience, leveraging data-driven insights to meet consumer needs more effectively.

Payment methods also evolved, with digital wallets gaining popularity alongside traditional credit card transactions, offering consumers greater convenience and security. This shift underscores the growing importance of integrating cutting-edge technology and flexible payment options to drive sales and improve customer satisfaction in the competitive retail landscape.

38. 2023 holiday season, 'Buy Now, Pay Later' (BNPL) usage reached an all-time high, contributing $16.6 billion in online spending—a notable 14% year-over-year increase, amounting to $2.1 billion more than the previous holiday season.

39. A significant 79% of people have minimal to no confidence in retailers' ability to use artificial intelligence responsibly, according to Deloitte.

40. Salesforce reports that AI-driven seamless and personalized shopping experiences have significantly boosted online growth and customer profitability. AI influenced $51 billion in global online sales through targeted offers, product recommendations, and generative AI-powered chat services.

41. Personalized Black Friday emails achieve a 15% higher open rate than generic ones (Notify Visitors).

7. Post-Purchase Behavior

Retailers made significant strides in addressing post-purchase behavior during Black Friday 2023 by improving transparency around discounts and return policies. This focus led to a normalization of return rates at 5%, down from record highs observed during the previous Cyber Week.

Customer satisfaction scores improved as a result of these efforts, reflected in more positive online reviews and ratings. However, challenges remain, as the global rate of online shopping cart abandonment on Black Friday continues to range from 73% to 78%.

42. Retailers took note of feedback from previous years and improved transparency around discounts and return policies. Following a record-high rate of returns during last Cyber Week, when consumers exchanged gifts for better deals, return rates have normalized to 5% this week (Salesforce).

43. The global rate of online shopping cart abandonment on Black Friday ranges from 73% to 78% (CapitalOne Shopping Research).

8. Regional Differences

Black Friday always reveals distinct regional differences in sales performance and consumer behavior.

These statistics and insights highlight the importance of tailoring marketing strategies to align with regional consumer behaviors and preferences.

44. Facing inflationary pressure and tighter budgets, U.S. shoppers turned to alternative payment methods such as Buy Now Pay Later (BNPL), resulting in an 8% year-over-year increase in orders (Salesforce).

45. According to Salesforce, U.S. consumers also increasingly used mobile wallets for convenient phone transactions, with usage rising 54% year-over-year, largely driven by Apple Pay.

46. In the United Kingdom, sales have been growing, with shoppers expected to spend over 8.74 billion British pounds during Black Friday in 2023 (Statista).

47. According to CapitalOne Shopping Research, Spanish shoppers tend to "window shop" online more frequently than most, with mobile users exhibiting an 88.4% cart abandonment rate.

48. UK shoppers are more likely to finalize their purchases, with tablet users having a 62.1% cart abandonment rate (CapitalOne Shopping Research).

49. In Europe, the percentage of consumers planning to cut back on Black Friday and holiday season spending varies by country (Statista).

50. In 2023, more than 30 percent of French consumers surveyed indicated that they intended to spend less on Black Friday compared to previous years. In Italy and Spain, just under 20 percent of respondents shared this sentiment (Statista).

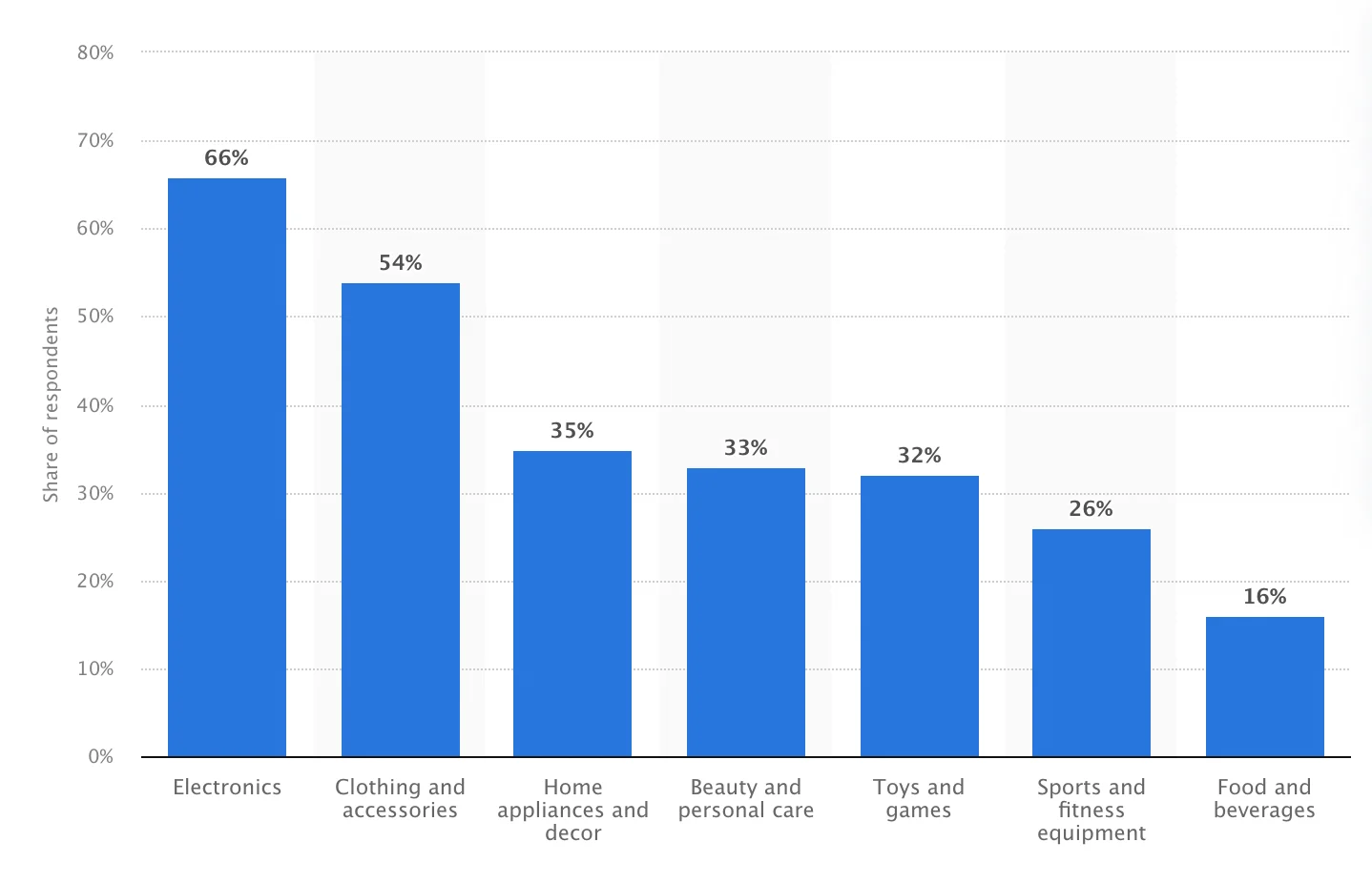

51. European shoppers indicated that their primary focus during Black Friday sales events was on electronics. A 2023 survey revealed that, aside from electronics, the other top categories of interest for European consumers were clothing and accessories, as well as home appliances and decor (Statista).

52. In China, Singles’ Day on November 11th is the biggest online and offline shopping day globally, with 2021 online transaction values exceeding 965 billion yuan (Statista).

53. In Mexico, "El Buen Fin," celebrated on the weekend before Mexican Revolution Day since 2011, features special promotions and extended store hours, similar to Black Friday (Statista).

54. Germany accounts for 12.9% of online Black Friday searches based on IP addresses (CapitalOne Shopping Research).

55. Brazil contributes 11.0% of online Black Friday searches, while the UK accounts for 10.3% (CapitalOne Shopping Research).

56. Spain, Canada, France, and the Netherlands collectively make up 19.2% of online Black Friday searches (CapitalOne Shopping Research).

57. In 2023, close to 20 percent of French consumers surveyed expressed a strong intention to prioritize sustainability while shopping during Black Friday. In contrast, just over 10 percent of consumers in Italy and Spain reported the same commitment (Statista).

58. A recent survey revealed that the average Black Friday budget for 2023 among Spanish consumers was around 273 euros. French consumers had the highest average budget, approximately 309 euros (Statista).

Key Takeaways and Predictions for Black Friday 2024

As retailers continue to blend physical and digital shopping, omnichannel experiences are set to dominate Black Friday 2024.

This approach ensures a seamless customer journey across various platforms—whether online, in-store, or through mobile apps.

Retailers will increasingly focus on integrating inventory systems, facilitating easy returns, and offering click-and-collect services to enhance convenience and drive sales.

In addition to the omnichannel trends, personalization will continue to be a critical factor in driving consumer engagement and loyalty. Leveraging data insights, retailers will offer highly tailored experiences—from tailored promotions to individualized product suggestions.

This level of personalization will extend beyond online platforms to in-store interactions, ensuring that every touchpoint resonates with the shopper’s preferences and past behaviors.

By focusing on personalization, retailers aim to create meaningful connections with consumers, increasing the likelihood of repeat purchases and long-term loyalty.